INTRoduction

Global Air Freight Learnings from H1 2025

The first half of 2025 has seen notable shifts in the global air freight landscape. A change in U.S. leadership is reshaping trade policies, creating ripple effects across procurement strategies, capacity planning, and cost structures. In this edition of Air Freight Pulse, DSV provides a detailed analysis of the evolving market conditions—including economic indicators, regulatory updates, rate developments, and technological advancements. We also examine the growing influence of environmental and sustainability initiatives, which continue to reshape the transport and logistics industry.

Air Index

Global Trends

Regional Breakdown

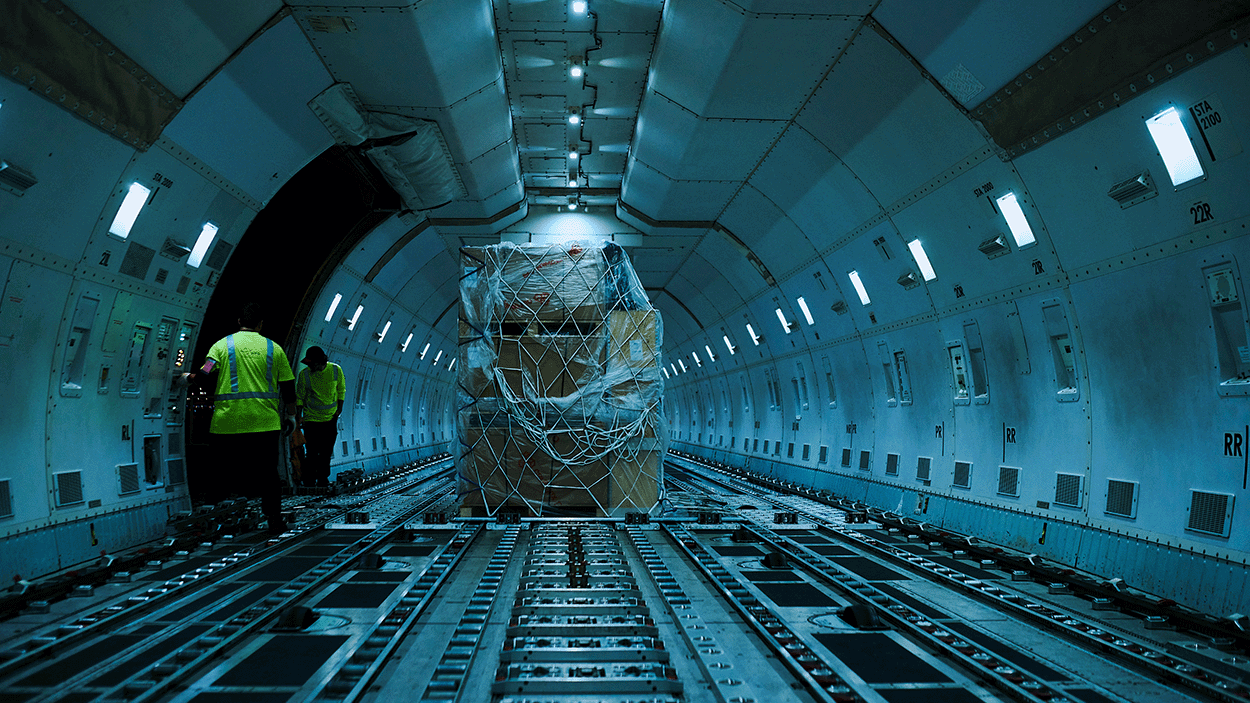

Capacity

Global airfreight capacity has grown by 3% YoY, primarily driven by increased freighter utilization. The flower trade from Colombia and Kenya has significantly contributed to this growth, especially around Valentine’s Day.

However, a decline in charter activity from China and Hong Kong has been observed post-holiday season, reflecting the impact of U.S. policy changes. Belly capacity is expected to rise with summer schedules, particularly on Transatlantic routes, while freighter airlines may shift focus to underserved markets in Latin America, Southeast Asia, and the Indian Subcontinent.

-

Global Growth

+3% YoY, driven by freighter utilization.

-

Belly vs Freighter

Belly capacity rising on passenger routes; freighter networks shifting toward underserved markets.

-

Regional Highlights: Colombia/Kenya

Flower trade boosted capacity.

-

Regional Highlights: China/Hong Kong

Charter activity declined post-holiday due to U.S. policy changes.

Capacity growth in 2025 is expected to be limited, with the existing freighter fleet used fully.

Ryan Keyrouse, CEO, Rotate

Sustainability

The EU Emissions Trading System (ETS) is phasing out free allowances, with 100% of emissions counted by 2026. This will increase operational costs for airlines and may lead to higher fares. Airlines are incentivized to invest in SAF, fuel-efficient aircraft, and carbon offsetting.

Implications include competitive pressure on EU carriers, reinvestment of ETS revenue in green aviation, and alignment with global climate goals such as CORSIA.

-

EU Emissions Trading System (ETS)

- Phase-out of free allowances: 100% counted by 2026.

- Impact: Higher costs for airlines → potential fare increases.

- Incentives: Push toward SAF, fuel-efficient aircraft, and carbon offsetting. -

Implications

- Competitive pressure on EU carriers

- Revenue from ETS reinvested in green aviation

- Alignment with global climate goals (CORSIA)

Consumer Interest

-

Headwinds

- Ocean Freight Gains: Suez Canal improvements shifting cargo from air to sea.

- US Tariffs: Causing sourcing shifts and capacity reshuffling. -

Demand Drivers

AI Boom: High-value, time-sensitive tech shipments from Southeast Asia and Taiwan.

- Diversified Sourcing: Growth in airfreight from India, Vietnam, and Thailand.

Industry Leaders & Executive Corner

Executive View

Procurement Strategy

Trade Policy Outlook

Access the full Air freight Market update

Any questions?

Our experts are ready to help. Get in touch and we'll find the solution you need.